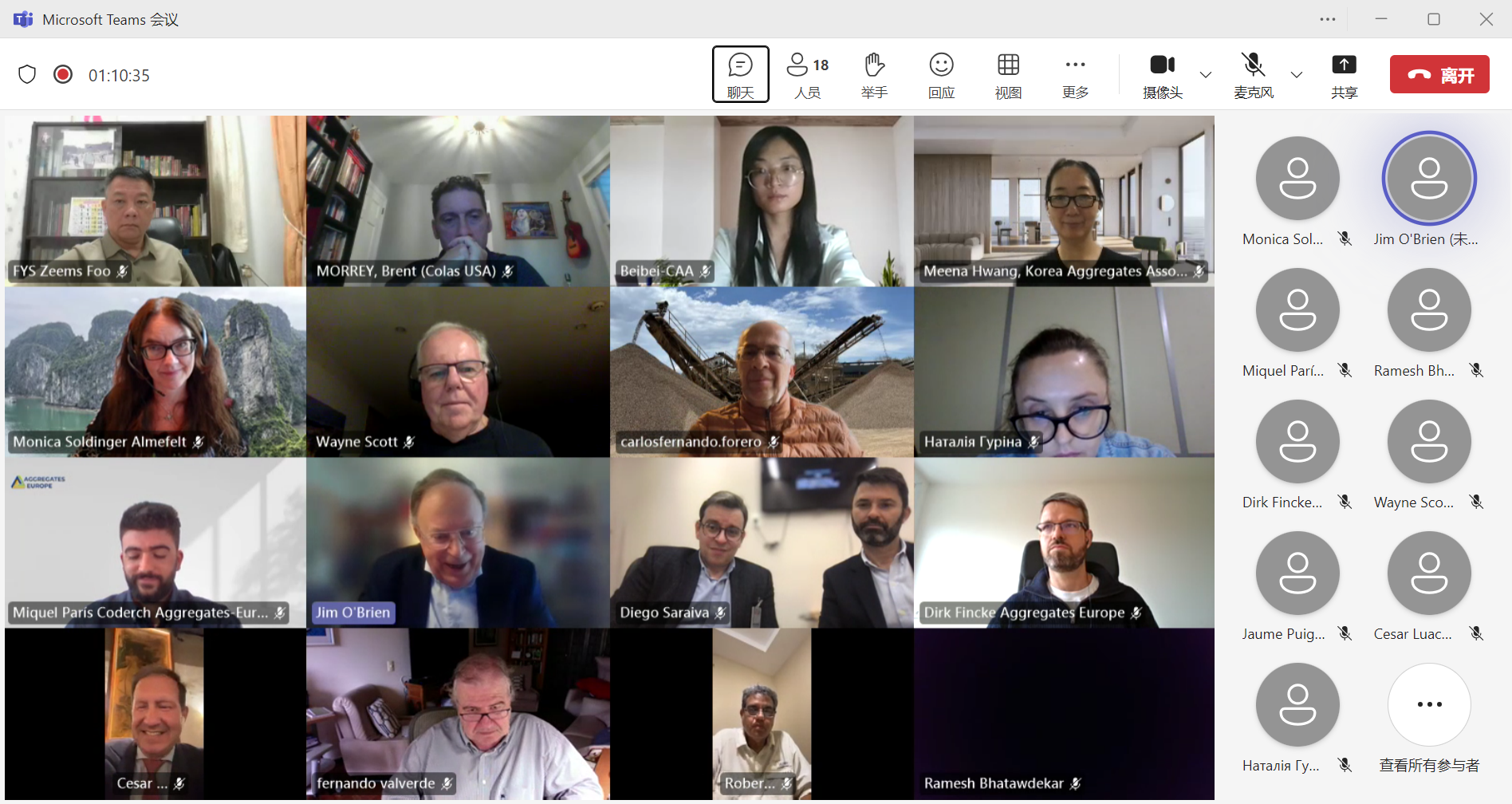

On September 17, 2025, the Global Aggregates Information Network (GAIN™) held its 32nd International Conference Call. Industry association representatives from more than 30 countries and regions jointly shared the industry dynamics in the first half of 2025 and the outlook for the second half, and discussed the Córdoba International Conference scheduled for October.

Latest Sand and Gravel Situation in Various Countries and Regions

Conclusion

From a regional perspective, infrastructure projects in emerging markets are the key driver of manufactured sand demand. Malaysia's sand and gravel sales remain robust, fueled by projects like the China-Thailand high-speed railway and Johor-Singapore rail links, spurring demand for efficient manufactured sand production lines and unlocking the potential of high-performance sand making machines. Panama's new government's infrastructure push—including the Millennium Bridge, Panama City subway, and Panama Canal new reservoir—will boost local needs for importing manufactured sand production lines and upgrading sand making machines as projects launch.

Mature markets focus on efficiency and structural optimization. In Europe, stable inflation amid high energy prices sees defense-driven demand indirectly boosting manufactured sand production capacity, while legislative simplification and tax adjustments reshape the sand making machine market. Canada's total output stays steady; New Brunswick's highway construction fuels seasonal demand, prompting enterprises to adopt flexible, efficient manufactured sand production lines, where energy-saving sand making machines are critical. Sweden's sluggish output is offset by stable per capita demand, supporting ongoing upgrades of sand making machines.

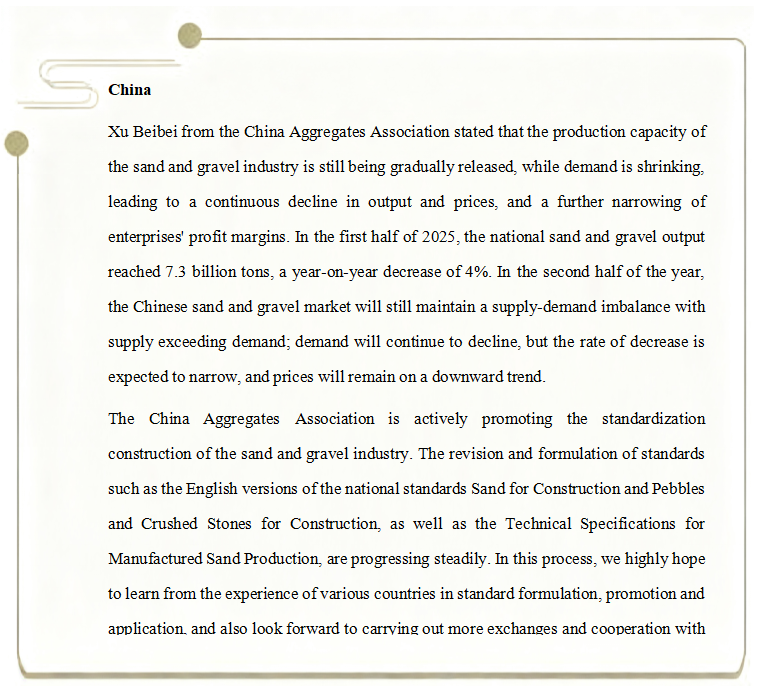

China's market faces oversupply, but standardization brings opportunities. The China Aggregates Association's efforts to revise standards like Sand for Construction will drive standardized upgrades of existing manufactured sand production lines and demand for high-standard new sand making machines. Long-term, industry standardization will push manufactured sand production lines toward intelligence and environmental friendliness, unlocking breakthroughs in sand making machine R&D and application.

Overall, global sand and gravel industry's regional divergence is reshaping the layout of manufactured sand production lines and sand making machine demand. Infrastructure growth, stricter environmental policies, and technological innovation will drive upgrades in both. Enterprises must leverage regional traits to seize opportunities with tailored products and technologies.

Source: China Aggregates Association